Now you’ll always know exactly what you owe and when you’ll be finished paying. That means you can spend less time bookkeeping and more time reliving those priceless tropical memories.

It only takes a moment to check your eligibility and the application does not affect your credit score.

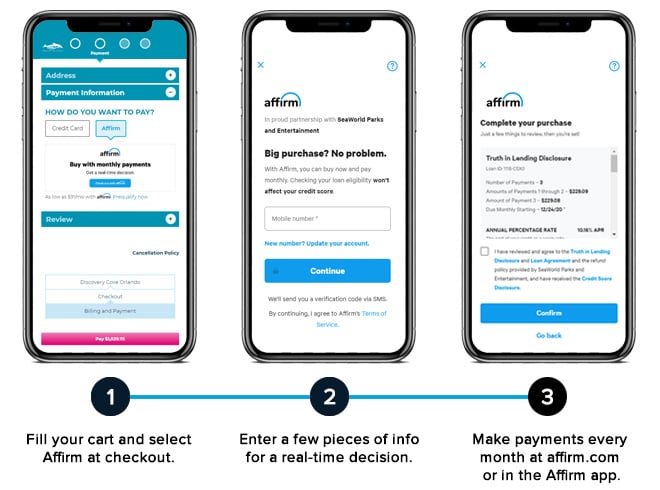

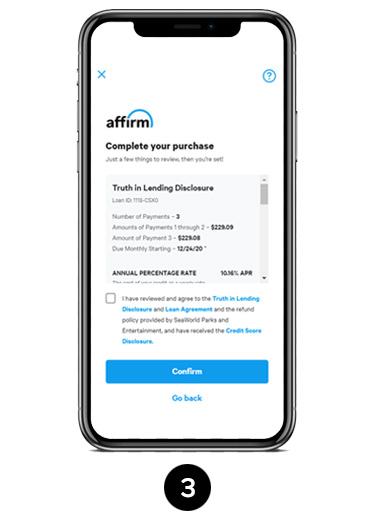

Buying with Affirm is simple

Just select

Buying with Affirm is simple

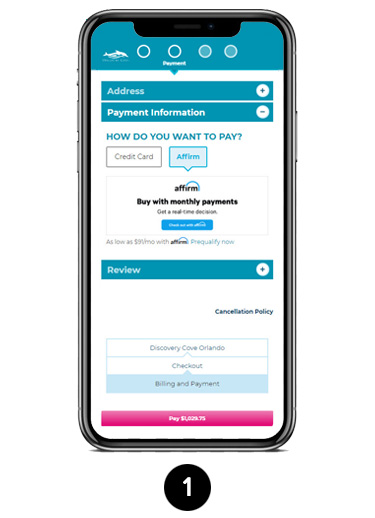

Fill your cart and select

Affirm at checkout.

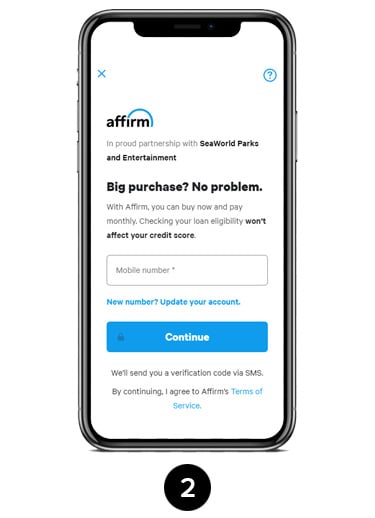

Enter a few pieces of info

for a real-time decision.

Make payments every

month at affirm.com

or in the Affirm app.

Just select